Paytm Payment System: A Complete Guide for Indian Sports Fans

Paytm is India’s multi-faceted payment system, which has changed the way sports fans manage transactions at betting sites and apps. It is a one-stop solution for seamless financial interactions, bringing together a wide range of services under a single digital umbrella.

What is Paytm?

Paytm is India’s leading digital payment platform offering end-to-end payment solutions to millions of users. Paytm was initially launched as a prepaid mobile recharge site and later expanded to include services such as utility bill payments, travel booking and integrated payment bank. The platform simplifies digital transactions by providing a user-friendly interface and a secure environment for financial transactions, making it the preferred choice for a wide range of customers, including businesses and ordinary consumers.

How Does Paytm Work?

Paytm works as a universal digital wallet, allowing users to store money and make transactions with various vendors. To enhance user convenience, Paytm supports saving credit or debit card details in the app to speed up payments, although CVV must be entered for every transaction to ensure security. Users can top up their Paytm wallet with cards or online banking, and then use those funds for online or in-store purchases using QR codes, or even transfer them directly to bank accounts.

Paytm for Sports Transactions

Paytm has revolutionized sports fans’ transaction management by providing fast, secure and worry-free payments. Here is a brief table with general information about Paytm:

Benefits of Paytm for Sports Fans

Paytm offers sports fans a convenient and secure platform to quickly make transactions, use cashback offers, and manage their sports spending without the hassle of traditional banking methods. Here are some of the key benefits:

Speed and Convenience

Paytm enhances the speed and convenience of transactions for sports fans. Whether it’s buying tickets to your favorite matches, making deposits or withdrawals, payments are processed instantly. With the app’s user-friendly interface, making a payment or transferring funds is just a few taps away, saving time and reducing hassle.

Cashback Offers and Rewards

Paytm is known for its attractive cashback offers and rewards, which are especially beneficial for sports fans. Regular promotions offer various opportunities to save money while enjoying your favorite events.

Multi-Functionality

Paytm’s multifunctionality is not just limited to payment sources, the number of which exceeds 100, including debit and credit cards, Netbanking, UPI, Paytm Bank Wallet and more. It also offers withdrawals from more than 2,00,000 ATMs across India and abroad, and provides services such as booking tickets for sporting events, paying for online streaming subscriptions, and participating in betting at various platforms.

Security Features of Paytm

Paytm uses advanced security features to protect user data and financial transactions. It uses strong encryption to protect personal and financial information, providing a secure environment for all users.

Paytm enhances security with two-factor authentication, which requires not only a password but also a confirmation code sent to the user’s mobile device. This additional layer of security helps prevent unauthorized access and secure user accounts.

Paytm uses sophisticated fraud prevention mechanisms to detect and prevent suspicious activity. Real-time monitoring and machine learning algorithms analyze transaction patterns to quickly identify and mitigate potential threats, ensuring user security and trust.

How to Set Up and Use Paytm?

Setting up and using Paytm is a simple process designed for user convenience, providing quick access to a range of payment services designed for sports fans and everyday transactions. Below is a step-by-step guide on how to start using Paytm.

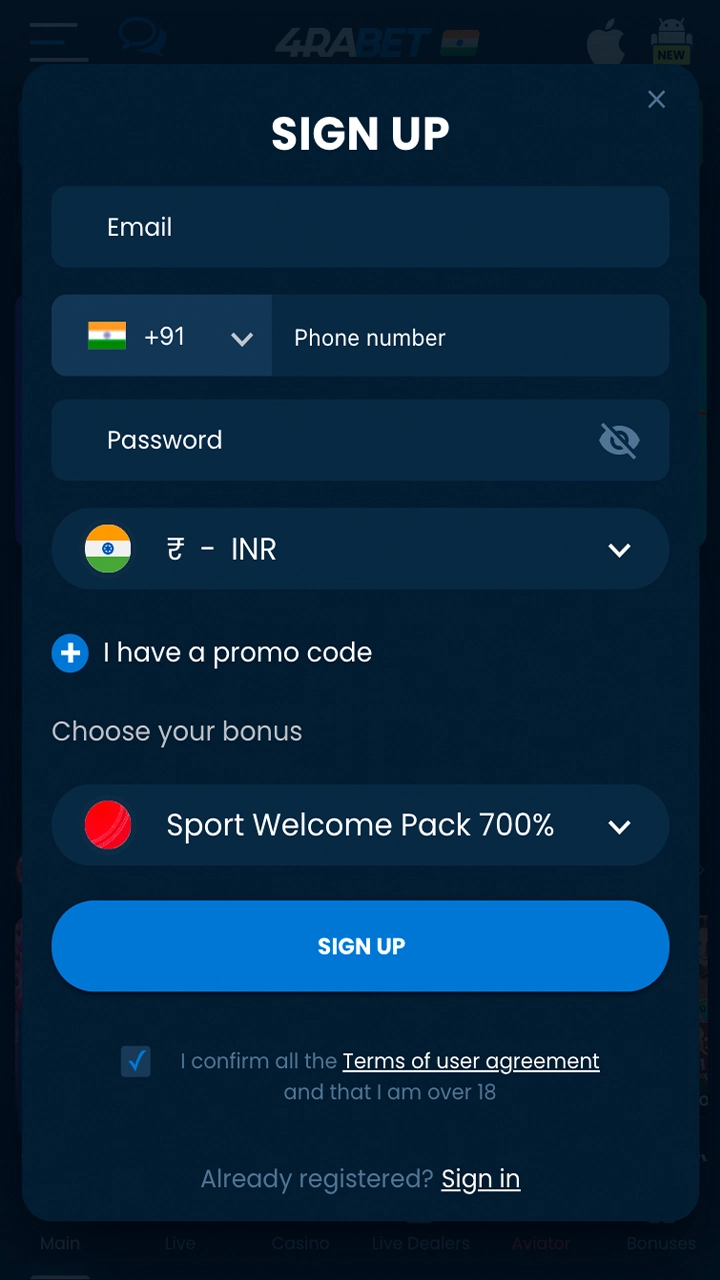

Step 1

Downloading the App and Creating an Account

To get started with Paytm, download the app from the iOS or Android app store. Once installed, open the app and follow the prompts to create an account by entering your mobile number, creating a strong password and providing the required KYC details to fully activate your account.

Step 2

Adding Money to the Wallet or Using UPI

Once your account is activated, you can recharge your Paytm wallet using credit/debit cards, online banking or UPI. Alternatively, set up UPI directly using your bank details, as this method will allow you to make payments directly from your bank account without having to pre-fill your wallet.

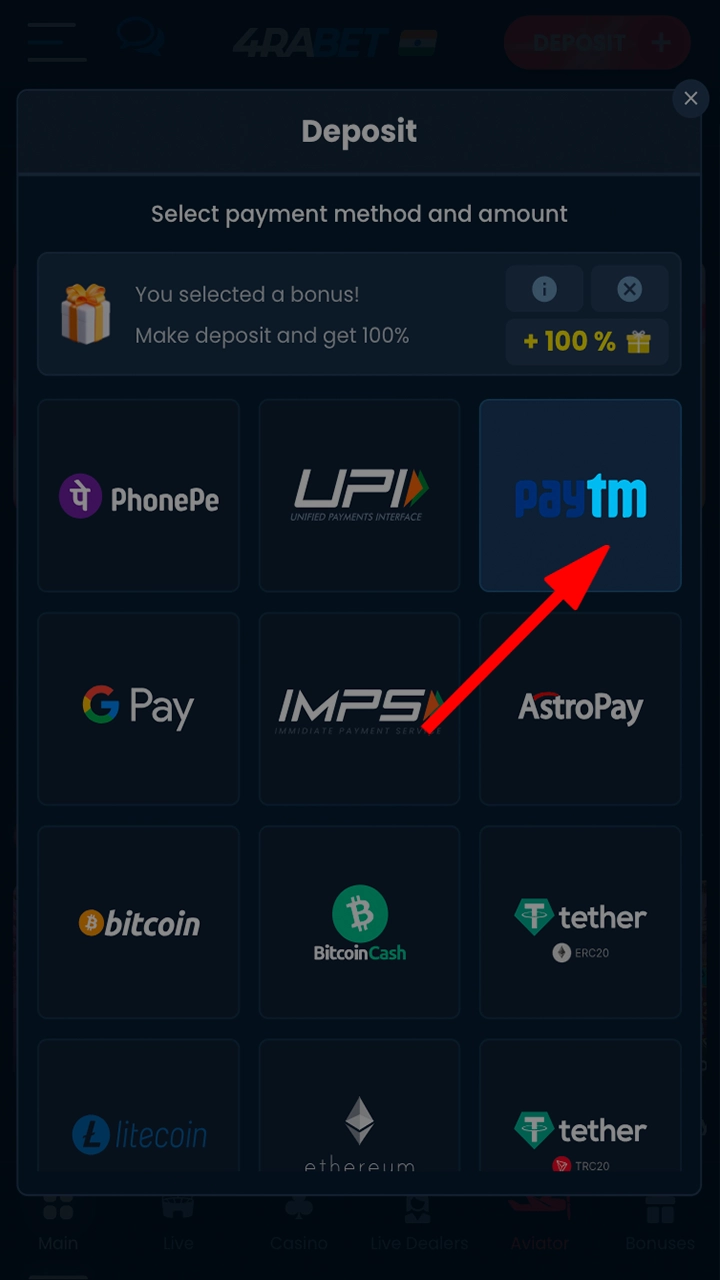

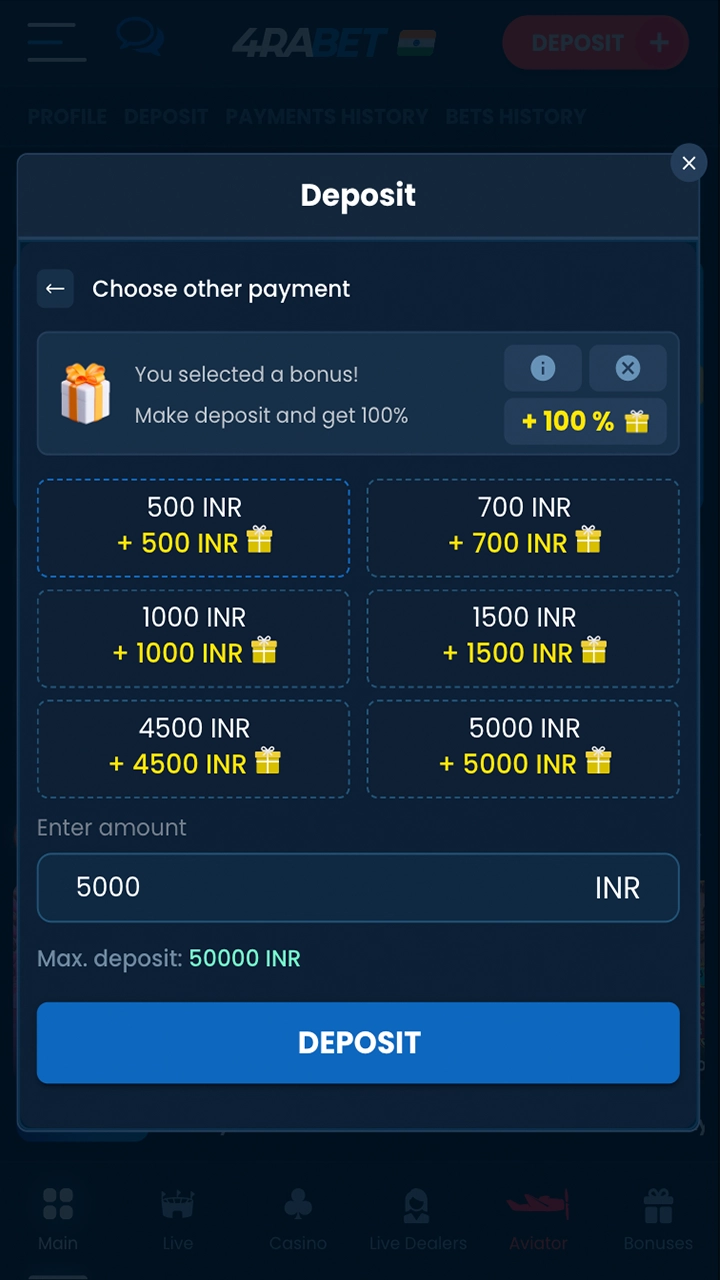

Step 3

Making Payments on Sports Platforms

Paytm makes it easy to make payments on sports platforms. Simply select Paytm in the Deposit section and you can pay via wallet balance or UPI. For faster transactions, keep your wallet topped up or set up UPI so you don’t miss a bet due to a delayed payment.

Transaction Limits and Fees with Paytm

Paytm provides clear guidance on transaction limits and fees, providing transparency and helping users plan their financial activities effectively.

Daily and Monthly Limits

Paytm sets transaction limits to ensure the security of financial activities and regulatory compliance. Daily limits are usually set at ?1 lakh, while monthly limits can vary depending on the user’s account type and KYC compliance. These are for frequent small transactions as well as large payments.

Through Paytm UPI, a user can make transactions up to Rs 20,000 per hour, with a cap of five transactions within that hour. Additionally, there’s a daily limit of 20 transactions through Paytm UPI.

Fees and Charges

Paytm generally offers users free transactions for most services, including money transfers to other Paytm wallets or bank accounts. However, certain transactions, such as credit card top-ups to your wallet or some merchant payments, may incur a nominal fee, which is detailed in the fees section of the app.

Common Challenges and Troubleshooting

Paytm users may occasionally face issues while conducting transactions. Understanding common problems and knowing how to resolve them quickly ensures a smooth payment experience.

Failed Transactions

Failed transactions are a common issue with digital payments. If your Paytm transaction fails, first check your internet connection and account balance. Ensure the recipient’s details are correct and retry the transaction. If the problem persists, it may be due to server downtime or technical glitches at Paytm’s end.

Contacting Paytm Support

If you have any problems or questions about your Paytm wallet, you can contact the Paytm support team, which is available 24×7. The support team can be contacted via paytm customer care number or email. All online merchants and Paytm payment gateway users get specialized support to ensure that any issues are resolved quickly.

Paytm’s Future in Sports Payments

As Paytm continues to innovate, its role in the sports betting payments industry grows significantly. Backed by its modern technology, Paytm aims to enhance the user experience at sporting events by offering faster transactions and exclusive offers such as cashbacks and rewards. By integrating artificial intelligence and machine learning, Paytm will be able to offer personalized promotions, increasing sports fan engagement and further simplifying the payment process.

Emerging Trends

Paytm’s future trends in sports payments include using blockchain for secure and transparent transactions. Paytm may also expand partnerships with major sports leagues to offer customized promotions and loyalty programs, strengthening its presence in the sports industry.

Conclusion

Paytm’s way in the digital payments sector has been transformative and has had a significant impact on various industries, including sports. Continuous innovation and adoption of new technologies will redefine how sports fans interact with and enjoy their favorite events. Paytm is expected to strive to improve the user experience and expand its services to remain one of the best payments systems in India.

Leave a Reply