Breaking down the IPL sponsorship jamboree in numbers

With the 16th edition of the Indian Premier League (IPL) having kicked off, its official broadcaster Disney Star and digital broadcast partner Viacom18 have finalised their list of sponsors. Barring any uncertainty in the economic environment amid talks of a slowdown in the market, the two have roped in 34 sponsors in total — the highest-ever tally for a single IPL season.

Last season, Disney Star had both the TV and digital broadcasting rights for the IPL. Star Sports roped in 14 sponsors for IPL 2022, while the OTT platform Disney+ Hotstar roped in 18 more to make it 32 sponsors in total, which accounted for approximately ?4,600 crore in total revenue. Interestingly, as per reports, Disney Star said that it had exhausted 95–100% of its broadcasting sponsorship inventory for the 2022 season.

Although this season marks the longest sponsorship list, it hasn’t translated to a bigger intake in revenue. In fact, there has been a significant drop (23.91%) in total revenue at the time of writing. As per reports, this season’s TV broadcaster Disney Star has sold only about 65–70% of its sponsorship inventory.

As of April 1, 2023, Disney Star has raked in ?2,500 crore in broadcasting revenue, which falls significantly below the ?3,100 crore it was able to bring in last year.

Sources close to Disney Star confirmed that the company was looking at around ?3,800 crore in total revenue after estimating a 15–20% hike in sponsorship prices, thereby subsequently expanding its sponsorship inventory for this season.

Disney Star is looking at ?17–18 lakh for a ten-second spot on average for league matches but is asking close to ?33–35 lakh for the Playoffs. If this trajectory holds, Star may be able to sign another ?400–500 crore worth of sponsorship deals.

On the other hand, digital IPL broadcaster Viacom18 is asking for ?6.5 lakh per ten-second spot on connected TVs, while for other video ads—pre-roll and mid-roll—it’s asking for ?200 CPM or per 1,000 impressions for a minimum commitment of ?15 lakh. So far, it has signed up with 18 sponsors, rounding off its total revenue at ?1,000 crore at the time of writing.

Similar to Disney Star, as per media reports, Viacom18, too, is significantly short of its expected internal target of ?2,800 crore. While negotiations are still ongoing, sources believe Viacom18 is—at best—expected to rope in another ?300-500 crore in sponsorship revenue; it, too, is expected to fall short of the target set out initially.

But what has led to such a drop in broadcasting sponsorship revenue generation for one of the biggest franchise T20 cricket leagues in the world?

Failure to meet the 20% bump expected can be attributed to the macroeconomic climate. There are a lot of sponsors that initially thought about wanting to partner with the IPL but pulled back because of a lack of clarity on what the economic outlook would be — not just in India, but also globally.

Moreover, the standoff between the two broadcasting networks might have also played a role in confusing advertisers. As a result, many decided to hold back and go in at the eleventh hour, maybe to get a better price, which is why this time deals are still being signed and negotiated by both teams and broadcasters after the season having officially begun.

Another important factor that might have played a key role is the lack of start-up participation in this year’s tournament. Last season, out of the 14 sponsors signed by Star Sports, eight were startups. Similarly, 12 out of Disney+ Hotstar’s 18 sponsors were startups. If we look at this year’s sponsors, there is hardly any startup representation in terms of broadcasting partners or sponsors.

Data from Venture Intelligence shows that venture funding into Indian startups fell by a third, to US$23.9 billion in 2022 from US$35.5 billion in 2021, leading startups and unicorns to rationalise their costs and cut down on expenditures. In April 2022, venture capital funds investments in startups fell by 27%, to US$1.6 billion over 82 acquisitions, according to a report by the industry group IVCA and EY.

This lack of investment and representation of startups is also visible among the IPL franchise sponsors too. Last season, there were 29 Indian startups participating in the biggest cricketing carnival as sponsors or partners for the ten IPL teams. This has dropped to 19 Indian startups for IPL 2023 — a 35% year-on-year decline in the number of startups participating in IPL 2023 as partners or sponsors.

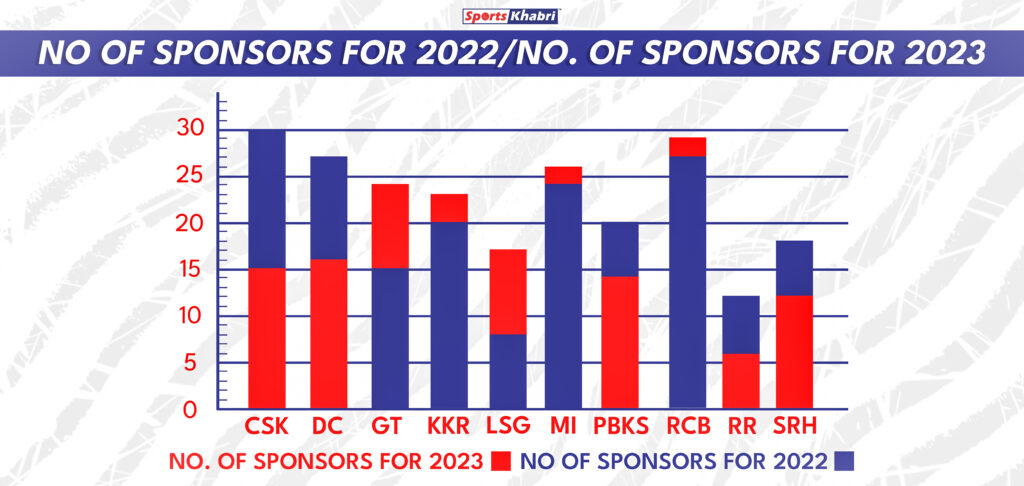

This has also impacted how the teams shape up in the sponsorship table. While half of the teams have been able to build on their sponsorship portfolio from last season, the other half’s fortunes have dipped massively.

Last year’s new boys, the Lucknow Super Giants and the Gujarat Titans, were the biggest movers with 113% and 60% sponsorship growth, respectively. The Royal Challengers Bangalore raked in the most sponsors with 29, while the Kolkata Knight Riders and the Mumbai Indians were the startup companies’ preferred destinations with six deals apiece.

On the other end of the spectrum, the Chennai Super Kings’ count of sponsors dropped from 30 to 15, as did the Delhi Capitals’ — from 26 to 17. Interestingly, the Rajasthan Royals had the biggest pot of startup sponsors last year with five; this year, they have entered the competition without a single startup company in their sponsorship portfolio. Lastly, the SunRisers Hyderabad signed the least number of new sponsorship deals with just two.

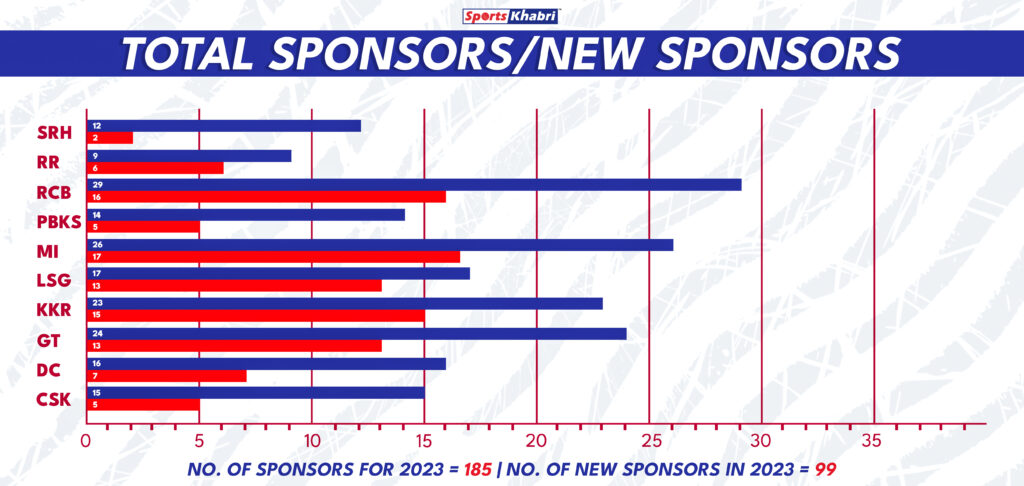

If we look at the teams that signed the most deals this season, it is the usual trio of the Mumbai Indians (17), the Royal Challengers Bangalore (16), and the Kolkata Knight Riders (15) — with the exception of the Chennai Super Kings (5) — who are making the splash off the field. The Lucknow Super Giants and the Gujarat Titans aren’t too far off either, having signed 13 deals each.

When we zoom out and look at the broader picture, 99 out of 185 team sponsorship deals signed so far have been new deals, which roughly stands at 53.5%. Although this might give readers the feeling that new brands are joining in, what this doesn’t highlight is the decline in the number of deals being signed. If we compare the numbers across the two seasons, there is an ~8% dip in the average sponsorship count for this season.

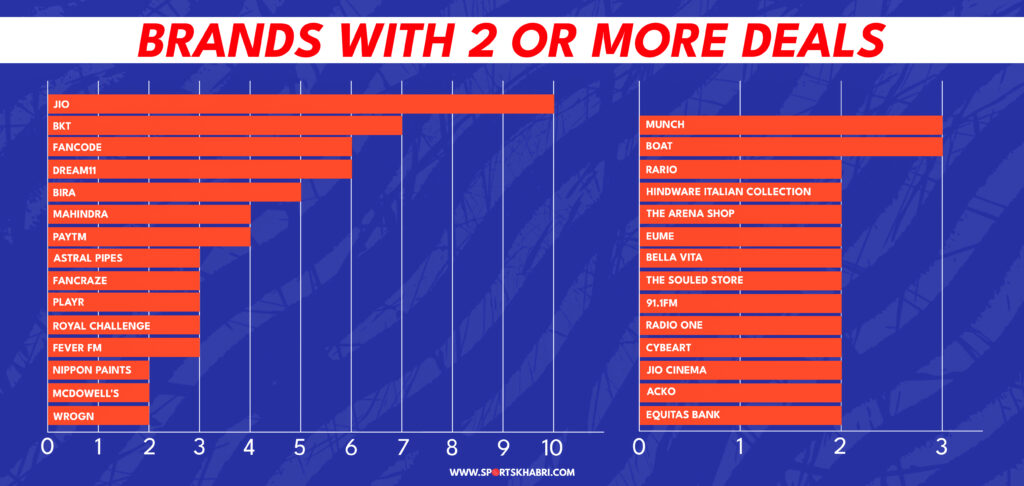

However, when we dive a bit deeper into this, we’ll find that a lot of the new and existing brands have tied up with two or more teams. Reliance Jio, which has been associated with IPL franchises since 2018, has signed up with every single IPL team either as a partner or a sponsor. Behind Jio is tyre manufacturer BKT, fantasy sports platform Dream11, and online merchandise retailer FanCode Shop with seven, six and six team associations, respectively.

Among new sponsors, boAt, Mahindra & Mahindra, Equitas Bank and Royal Challenge have been heavily involved in tying up deals with multiple franchises. On a similar scale, new startups like Bira91, PlayR, The Souled Store, EUME, Bella Vita, Shop The Arena and Rario have shown faith despite market uncertainty.

This has changed the landscape of sponsorship revenue generation for IPL teams, as teams continue to scramble to rope in more sponsors till the season eventually draws to a close.

As per various media reports, sponsorship revenue for IPL franchises is expected to increase by 8–10%, with many of the franchises earning in the range of ?100–120 crore this year, with some teams already reporting a 50% growth.

The Delhi Capitals’ sponsorship revenue went up by 50% from last year, said Dhiraj Malhotra, the franchise’s CEO, in a press release. Similarly, the Gujarat Titans and the Lucknow Super Giants, who had 15 and eight sponsors last season, respectively, are expected to post similar figures, with their sponsorship revenue catching up to the middle pack.

All three of the Royal Challengers Bangalore, the Mumbai Indians and the Kolkata Knight Riders have emerged as the highest sponsorship revenue earners, while the Chennai Super Kings, with their loss of sponsors, have taken a hit and are closer to the Delhi Capitals than the leading pack. Unfortunately, the Rajasthan Royals have been hit the worst, especially with the loss of their five startup sponsors that made up a significant portion of their revenue intake. As things stand, they have the lowest sponsorship revenue intake out of the ten IPL teams.

However, as stated above, analysts and sports marketers have noted that the overall growth in sponsorship (8–10%) is not significant due to a tough spending scenario as startups and tech companies are reining in their marketing budgets.

This growth has drastically come down from last season’s 20–25% growth, which is largely due to the slowing down of spending from the startup sector, which was at its peak during the last two years. Thus, what we are seeing as an 8–10% growth is primarily down to the two new franchises roping in more sponsors and driving the overall growth in this segment.

If we exclude the two new teams, we see an approximate 21% percent drop in sponsorship deals for the original eight IPL teams. Thus, the question arises — where do the league and its franchises go from here?

From a franchise perspective, growth has been strong over the past three years as teams diversify their revenue streams. The Delhi Capitals, for example, have seen a cumulative growth of 80% in sponsorship revenue over the last two seasons. Both the Royal Challengers Bangalore and the Mumbai Indians are expected to post solid double-digit growth percentages, while the Kolkata Knight Riders, despite having to let go of many of their sponsors due to various reasons, have been able to recoup more than what they’d let go.

This has resulted from teams diversifying their revenue streams from just jersey sponsorship to licensing and merchandising, content, Web3 strategisation and other such avenues.

The Mumbai Indians have got on board playR, a sports and lifestyle company, as one of their official merchandise partners for the 2023 season. The Gujarat Titans have tied up with digital collectibles platform Rario, which will offer digital player cards of the team to fans for three years. Similarly, FanCode Shop, the merchandising arm of FanCode, has announced a long-term partnership with the Rajasthan Royals.

On the other hand, online gaming platform WinZO, which was the principal sponsor of the Knight Riders in 2022, has missed out this season. This is because of new guidelines that exclude real-money gaming companies from advertising or sponsorship during the IPL, which, according to the company, appears to be arbitrary.

While there are some challenges for IPL sponsorship deals due to a myriad of reasons — from macroeconomic uncertainty to confusion over broadcasting network battles or the legality of some sponsors — there are also opportunities one can tap into in a market like this.

There is an opportunity to unlock corporate social responsibility (CSR) spending. Brands have been looking at spending their CSR budgets on sports for some time now. As of March 2023, the sponsorship market is valued at around ?9,000 crore, whereas CSR spends range between ?17,000 crore and ?18,000 crore. However, as per reports, the sports CSR spending as of now is only ?250–300 crore. So, there is a huge delta in both markets to co-exist and expand over the coming years.